News

By Federico Savini, University of Amsterdam, co-initiator of de Nieuwe Meent, a new housing cooperative in Amsterdam

Crowdfunding is fast becoming an essential practice for many start-up cooperatives. Other than in countries with a well-established cooperative housing sector like Germany, Austria or Switzerland, many countries lack this tradition of resident driven housing development and an existent financial framework (banks) who finance cooperative initiatives. It is particularly crucial for small-scale housing cooperatives that operate with a high degree of involvement of their tenants and members, and that do not envisage long-term profit nor financial enlargement. These start-up cooperatives may find it challenging to enter inflated housing markets such as those of large urban agglomerations. In those markets, banking institutions often consider the setting up of a housing cooperative as a risky endeavor and therefore fund only a portion of the project. Under these conditions, crowdfunding becomes a decisive step in the early life of cooperatives.

Crowdfunding: an opportunity for cooperatives

Crowdfunding is not only an essential need but also an opportunity for cooperatives. It can enable financial autonomy in cooperatives whose mission is to reduce the vulnerability of housing tenure on financial markets. Cooperatives can enjoy more control in setting the interests rates for the bonds they issue and modulating these rates according to the architectural, structural and environmental characteristics of the buildings. They can also target specific investment markets, linking their financial status to socially responsible and ecologically minded funds. As a EU study on the funding of community land trusts shows, these may include non-for-profit agencies, charities, crowdlenders, trusts, community engaged organizations and large scale social investment funds.

However, the success of crowdfunding campaigns is highly uncertain. A slow start could refrain investors to join the project. Funders may be reluctant to trust innovative and emergent cooperatives, especially to those operating in housing markets not familiar with the cooperative form. Crowdfunding can therefore become a curse, a burden on the shoulder of tenants seeking for resources to ensure affordable housing. Slow campaigns could delay the projects, impact negatively on the overall business case of the project and, in turn, decrease the chances of success.

A solid strategy makes crowdfunding successful

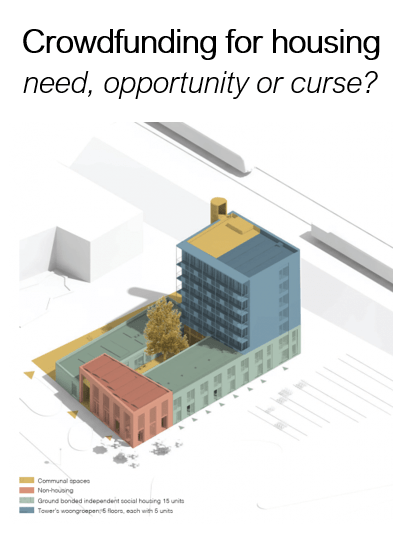

Successful crowdfunding campaign require a solid strategy of fund raising and a targeted program. They need to secure significant early investments by trusted partners, which will them function as locomotive for the others. To do so, a clear project identity is essential to give visibility to the campaign. Crowdfunders look for socially engaged, responsible and environmentally minded projects. They feel part of a group supporting a vision and a way of life, not only a housing estate. This is the experience of de Nieuwe Meent, a start-up citizen-based housing cooperative building an ecological community in Amsterdam. Are you interested how this Amsterdam based housing cooperative started their crowd funding? Please visit their crowdfunding campaign here.